Re: What are you reading?

Posted: Tue May 07, 2019 4:29 am

I'll pick it up soon, good review

So I finally read some of this stuff.Jwar wrote:Some of it is bizarro, but most is just straight hardcore horror. hahaha. It's weird how they have genre classifications for this stuff now.

Recommendations....hmmmmm....

OK! For fucked up shit that may test your morality and gut I'd recommend

JF Gonzalez Survivor (seriously fucked up)

Edward Lee The BigHead, Creekers (I read this in one sitting hahaha), GAST, Header 1-3...oh so many Ed Lee titles.There's only a few that I'd call kind of stinkers.

Jack Ketchum Offspring

Bryan Smith Depraved

Poppy Z Brite (anything but that Courtney Love shit)

Charlee Jacob This Symbiotic Fascination

Man I've got so many more. I'm going to make an actual list.

Agreed on Shattered Sea Trilogy. Really liked Thorn and her relationship — enjoy the slightly lighter grimdark thanks to the YA nature. But yeah, they’ve got nothing on Ninefingers.TraceItalian wrote:I'll never be able to unread that. I just disliked him for his good vs evil narrative and that his books are shit for rereading. But I still try to read each onecloudscapes wrote:Ithink the thing I dislike about Steven King is he wallows in pubescent torment. And why is there always an awkward horny fat guy?

I just got done with Joe Abercombie's half a king trilogy. I liked em, but not as much as his more adult leaning books

Interesting stuff. Manson’s connections pre Tate crime have always been interesting.$harkToootth wrote:I might have to get this for my dear friend, fellow ILFer, ibarakishi.

MAKING POOR MAN'S GUITARS: Cigar Box Guitars, the Frying Pan Banjo and Other DIY Instruments (Fox Chapel Publishing) Step-by-Step CBG Projects, Interviews, and Authentic Stories of American DIY Music by Shane Speal

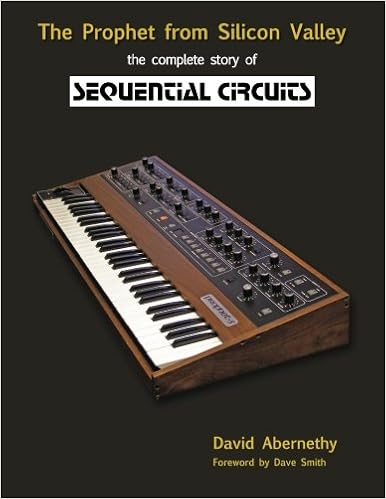

Also, I FINALLY splurged and bought this...

THE PROPHET OF SILICON VALLEY: THE COMPLETE HISTORY OF SEQUENTIAL CIRCUITS by David Abernethy. The only other synth book I have read is ANALOG DAYS by Trevor Pinch (about Moog), and It was FANTASTIC. If I'm not posting here for a minute, it's cause I'm reading.

Also, inspired by Retinal Orbita, at some point, going to give this one a go. A local library has it. Might have to re-read HELTER SKELTER again, first though.

CHAOS: CHARLES MANSON, THE CIA, AND THE SECRET HISTORY OF THE SIXTIES by Tom O'Neil.

I just got doene with it last night, but have you read Capitalist Realism? It kinda dovetails that. Plus, his mentor is batshit insane, so thats funJereFuzz wrote:Wrapping up "Between Debt and the Devil" by Adair Turner. It was published in 2016 and is another "crash of 2008 and its consequences" book. Nevertheless, it's a good one and it argues that credit expansion was good when it was used for capital investments that had a rate of return greater than the cost of interest and added significant efficiencies to an economy. But the financial/credit system expanded rapidly and now credit is used primarily for non-productive consumer spending (housing/toys/etc.). After the 2008 collapse, the economy is now hung over with debt overhang. Lowering consumer spending to pay down debt leaves a "hole" in the economy. This is filled with government spending. Hence, private (mortgage) debt that sunk the economy in 2008 has been transferred to the public sector. What's not clear is what to do next. The debt/GDP ratio was 62% in 2007. Today it is 108%. Consumer debt/GDP fell in the years following the 2008 collapse but it is now going up again. Anyway, interesting stuff.

You mean his mentor “Rosos”? His The Crash of 2008 was excellent. An easy read that lays out his reflexivity “theory”. I tried reading the Alchemy of Finance years ago but found it “what?” I realize now that he should have used the word “feedback loop” instead of reflexivity. But I don’t think that his AOF was edited, seriously. If I remember correctly his “essays” which were the basis for AOF used to faxed around during the 80s due to their insight. These were the basis for his book AOF. Don’t quote me. I’ll check out. Capitalist Realism? I’ll check it out. Oh, btw, I was referring to Turner’s “associate/mentor”TraceItalian wrote:I just got doene with it last night, but have you read Capitalist Realism? It kinda dovetails that. Plus, his mentor is batshit insane, so thats funJereFuzz wrote:Wrapping up "Between Debt and the Devil" by Adair Turner. It was published in 2016 and is another "crash of 2008 and its consequences" book. Nevertheless, it's a good one and it argues that credit expansion was good when it was used for capital investments that had a rate of return greater than the cost of interest and added significant efficiencies to an economy. But the financial/credit system expanded rapidly and now credit is used primarily for non-productive consumer spending (housing/toys/etc.). After the 2008 collapse, the economy is now hung over with debt overhang. Lowering consumer spending to pay down debt leaves a "hole" in the economy. This is filled with government spending. Hence, private (mortgage) debt that sunk the economy in 2008 has been transferred to the public sector. What's not clear is what to do next. The debt/GDP ratio was 62% in 2007. Today it is 108%. Consumer debt/GDP fell in the years following the 2008 collapse but it is now going up again. Anyway, interesting stuff.

Well, Capitalist Realism looks very interesting after reading about the author. I am familiar with zero books and have a bunch of them on my “to read” list. So I assume you are referring to Zizek as the mentor. He’s entertaining but I haven’t delved into his works. I see CR is at my local B&N ... i’ll pick it up.TraceItalian wrote:I just got doene with it last night, but have you read Capitalist Realism? It kinda dovetails that. Plus, his mentor is batshit insane, so thats funJereFuzz wrote:Wrapping up "Between Debt and the Devil" by Adair Turner. It was published in 2016 and is another "crash of 2008 and its consequences" book. Nevertheless, it's a good one and it argues that credit expansion was good when it was used for capital investments that had a rate of return greater than the cost of interest and added significant efficiencies to an economy. But the financial/credit system expanded rapidly and now credit is used primarily for non-productive consumer spending (housing/toys/etc.). After the 2008 collapse, the economy is now hung over with debt overhang. Lowering consumer spending to pay down debt leaves a "hole" in the economy. This is filled with government spending. Hence, private (mortgage) debt that sunk the economy in 2008 has been transferred to the public sector. What's not clear is what to do next. The debt/GDP ratio was 62% in 2007. Today it is 108%. Consumer debt/GDP fell in the years following the 2008 collapse but it is now going up again. Anyway, interesting stuff.